31st October 2019

ALLSAINTS RETAIL LIMITED – RESULTS FOR THE YEAR ENDED 2 FEBRUARY 2019, AND UPDATE ON CURRENT TRADING

Sixth year of consecutive top-line growth

Strong H1 trading since the year-end (i.e. the six months ended 3 August 2019), with the Group achieving LFL sales growth of 14%, as well as a 63% year-on-year increase in non-retail revenues; continuing sales growth so far in H2

Clear product, marketing and distribution strategies in place to drive future performance, including the launch of new lifestyle categories such as fragrances and watches

31 October 2019: AllSaints Retail Limited (“AllSaints” or “the Group”), the global contemporary fashion brand, provides an update on current trading as well as its audited financial results for the 52-week year-ended 2 February 2019.

Financial highlights for the year-ended 2 February 2019

- Sixth year of consecutive top-line growth, with total sales of £331.0m (2018: £327.1m)

- Revenue growth in every channel - i.e. retail, digital and non-retail*

- International (i.e. non-UK) sales now represent nearly 50% of total business mix, with Asia up 10% during the year

- Operating profit of £3.6m, versus an operating loss in the prior year of £6.2m

- EBITDA before exceptional items flat at £20.6m (2018: £20.6m)

*Non-retail includes wholesale, franchise and travel

Recent developments and current trading

Significantly strengthened leadership team:

- Peter Wood appointed CEO in September 2018, having previously been COO and with the brand since 2010; Catherine Scorey Jobling appointed COO in January 2019, having previously been Womenswear Director at Ted Baker

Refocused strategy under new management:

- Product-focused strategy to enhance the brand's product proposition with increased investment in core apparel categories, a broadening of the brand's footwear & accessories assortment, and the launch of new lifestyle categories such as fragrance and watches

- Increased investment in marketing which is delivering accelerated growth in the brand's global audience and engagement

- Strategic development of the brand's non-retail revenue channels in each region, building strong relationships with key wholesale, franchise, travel retail and licensing partners

Recent initiatives now delivering tangible results:

- Strong trading since the year-end, with the Group achieving year-on-year sales growth of 15% in the first half of the current financial year (i.e. ended 3 August 2019), driven by LFL sales growth of 14%, as well as a 63% year-on-year increase in non-retail revenues; continuing sales growth so far in H2

- Careful management of gross margin and good cost discipline ensuring the strong sales growth has resulted in corresponding improvements in EBITDA for the year to date

Commenting on current trading and on last year’s results, Peter Wood, CEO of AllSaints, said:

"The financial year that ended in February 2019 saw us deliver our sixth consecutive year of top-line growth and a resilient EBITDA performance set against the backdrop of challenging market conditions.

We are delighted that our focus on product, marketing and distribution has resulted in a significant and sustained step up in our performance since the second half of 2018 which we have further improved on so far in our new financial year. It is particularly pleasing that our H1 year-on-year sales growth of 15% was achieved via our teams delivering LFL sales growth in every country in which we trade and across every channel in which we operate. This includes our bricks and mortar retail stores, concessions and outlets, as well as digital and wholesale, franchise, licensing and travel retail.

Despite the ongoing challenging market conditions, we believe the strength of our brand, our clear strategic focus, and the quality of our team mean that we are well placed to deliver continued growth in future."

Performance review for the year ended 2 February 2019

The Group delivered overall revenue growth and maintained EBITDA profitability during the period. Revenues in the UK & Europe and North America were flat year-on-year, with revenue in Asia up 10%. The strong performance in Asia was the result of both the further development of the Group’s travel retail proposition, as well as continued growth in core retail sales.

The Group delivered revenue growth in every channel – i.e. retail, digital and non-retail - with the largest increases being generated in the Group's non-retail (40%) and digital channels (15%). Non-retail channels include wholesale business with leading department stores in each of the Group’s three key trading regions, as well as sales to franchise partners in 10 countries, and sales to leading travel retail partners. Also included within non-retail revenue is the Group’s licensing income, which is a new and developing business.

Gross profit margin increased to 65.3% compared with 64.9% in the previous period, driven by a reduction of promotional activity during the year.

The Group's EBITDA pre operating exceptional items for the period was flat on the previous period at £20.6m.

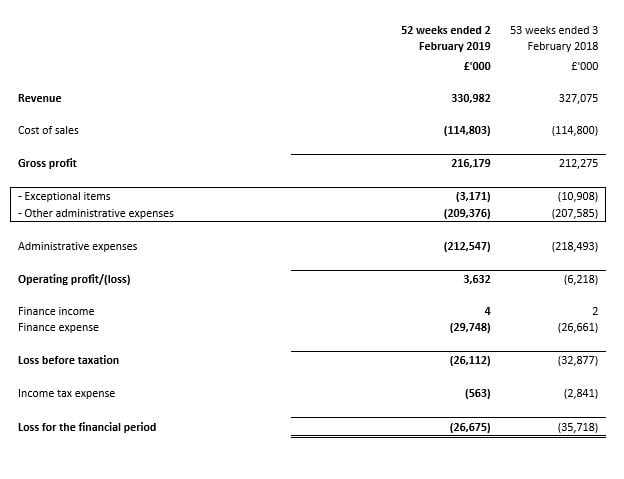

Group income statement for the year ended 2 February 2019