31st May 2022

Consumers add £1.4 billion more to credit cards in March

Commenting on figures released by the Bank of England today, Nicholas Found, Senior Consultant at Retail Economics says: “Household debt was above pre-pandemic averages for a third consecutive month with consumers borrowing £1.4bn more in credit in April according to Bank of England data released this morning.

“Inflation has already hit double digits among the least affluent households, who spend a disproportionate amount on food, fuel and heating, and are more likely to rely on unsecured debt to get by. With persistent high inflation in the pipeline, consumers have rising concerns about servicing their debt. Over a quarter of UK consumers have concerns about making repayments on their credit cards in April according to Retail Economics.

“These consumers are more likely to drive a cutback in non-essential spending going forward. Such has been the intensity of the flight to value across essentials in recent months, Retail Economics estimates that Aldi has seen an acceleration of market share of almost three years (32 months) since just the start of the year, compared to market share expectations based on long-run averages.”

Supporting data

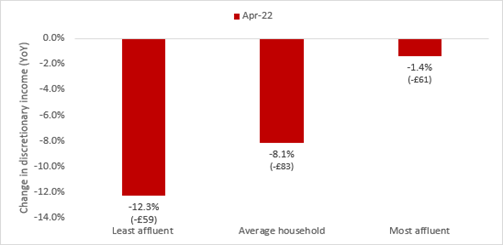

- The Retail Economics-HyperJar monthly Cost of Living Tracker shows the least affluent households faced the highest levels of inflation at 11.2% year-on-year (YoY) in April, as well as the weakest earnings growth at 4.1% YoY in the month. This has seen the least affluent face severe declines in their income available for non-essential purchases, with their discretionary income down by 12.3% YoY in April.

- By comparison, earnings growth of 4.6% YoY in April has better-supported income levels for high affluence household, with their discretionary income down by just 1.4% YoY in April.

Figure 1. Comparison of changes in discretionary income by household income group, year-on-year.

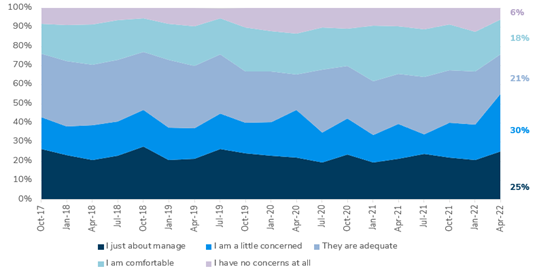

- A quarter of consumers only ‘just about managed’ with their personal finances in April, rising from around a fifth (21%) at the start of the year according to Retail Economics’ latest Shopper Sentiment Survey.

Figure 2: One in four consumers ‘just about manage’ with their finances