18th March 2019

Yes, buybacks have led to companies increasing their debt load

Global equities had a strong week, with MSCI World rising 2.8%, easily reversing the losses of the prior week and pushing the index to a 2019 high. Overall the index is now up 11.9% so far this year and just 6% short of its January 2018 high. Most regions made good gains during the week, with solid gains across seen in the likes of the Nasdaq (+3.8%), Brazil (+4.0%), France (+3.3%) and German Midcaps (3.5%).

But obscured by this strong performance have been lower profit growth expectations, with the US expecting just 5% EPS growth in 2019 versus 8% at the start of the year. Germany and France have both also seen 2019 EPS growth cuts, -300bp from 10% to 7%, but unusually both are expected to see EPS grow quicker than the US this year. The UK has lost 500bp of its 2019 growth target and now stands at just 1.6%. And while fingers will point to Brexit confusion, a big chunk of this downgrade stems from Oil & Gas and Pharma, which are also USD dominated sectors. Japan has seen the smallest cut at just over 100bp to 2.9%, yet ironically it is the poorest performer amongst all these countries year-to-date.

Press reports on the US corporate debt build-up and share buybacks are very much in prominence. One recurring topic is whether debt issuance and share buybacks are connected. Regular readers will know that we believe they are, as we have published numerous reports stating as such. But this still seems far from consensus.

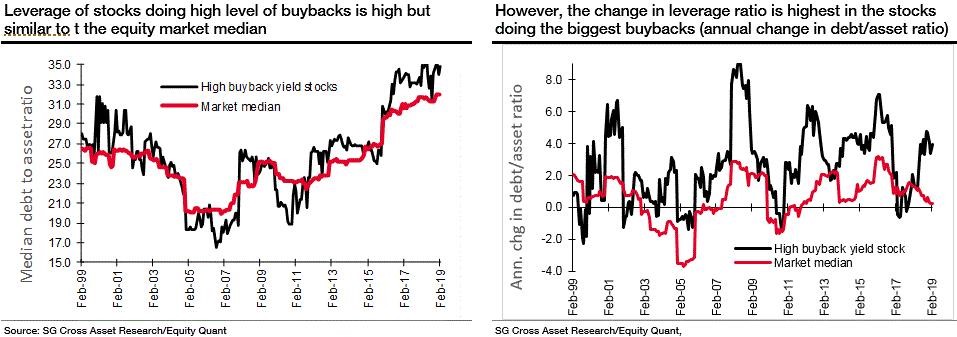

One possible reason for the confusion is a focus on leverage metrics (e.g. debt to assets) as the principal barometer of credit risk, when in our view what really matters is attaching inappropriate debt to a business that is unable to cope with. So, for example, a business with 60% leverage where the assets are all US bonds is very much a different credit risk to a business with 60% leverage where all the assets are Bitcoins. Another problem is how you measure share buybacks; in terms of the gross dollar amount or relative to the size of the company? We measure buybacks in terms of yield, i.e. relative to the market cap of the company and when we look at the evolution of debt-to-asset ratios of these stocks, it is quite clear that the change in this ratio is highest among those companies buying back the most stock.