15th October 2019

Cash-woe capitals: Birmingham, Leeds and Edinburgh top table of financial worries

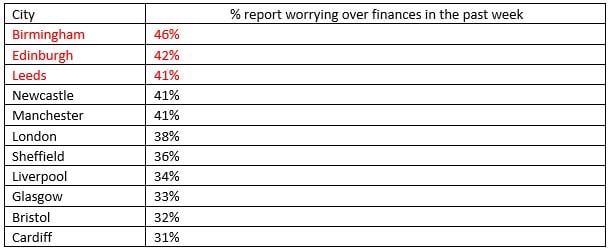

The UK’s most financially stressed cities have been revealed in a nationwide study, with Brummies coming out as the worst off.

The new research explored the effect of financial worries on people across the nation, but workers in Birmingham fare the worst. The second city had the highest proportion of people complaining of financial worries (46%), as well as the most people spending over five hours dealing with their money issues every week (26%).

In fact, Birmingham was in the top five for 15 out of 16 measures of stress caused by finances, including sleepless nights, anxiety and being prone to panic attacks. For 27 per cent of Brummies, this impacts their ability to complete daily work tasks on time, according to the survey by employee benefits provider Salary Finance.

Leeds came in a close second, placing in the top five for 12 out of 16 measures. The Yorkshire city is also the place where people are the most tight-lipped when it comes to money worries. Twenty-eight per cent said they ‘don’t feel comfortable talking about their finances to anyone’.

Edinburgh and Manchester are each in the top five for 11 out of 16 measures. But Edinburgh takes the number one spot more times than anywhere else. The Scottish capital reported the highest levels of credit card debt over £500 (48%), the most people unhappy with their current savings level (51%) and the most suffering depressed mood as a result of their finances (30%).

Workers in Manchester are most likely to find that money worries are having a negative impact on the quality of their work (26%). The Northern hub is also where the greatest proportion (34%) of people find themselves regularly running out of money before payday.

London was in fourth place, entering the top five for 10 out of 16 measures, and ranking as perhaps the most hand-to-mouth city. One in four Londoners have less than £500 available in their current and savings accounts combined.

Of the eleven cities ranked, it was Cardiff that came out as having the best financial wellbeing, although 31% still reported having financial worries.

Across the UK as a whole, finances are causing worries for 36% of the working population. Perhaps surprisingly, money worries were found to be significantly greater (73%) than concerns in other key areas of peoples’ lives, including relationships (38%), career (52%) and health (47%).

Personal lives also take a hit; those with financial worries are 12 times more likely to have troubled relationships with friends and family.

Moreover, those with money troubles are four times more likely to be suffering from anxiety and panic attacks (43%), and five times more likely to feel depressed (46%)*, compared to those with positive financial wellbeing.

Asesh Sarkar, CEO and cofounder of Salary Finance, said: “The research shows that financial stress has a real and negative impact on mental health for people across the country, and this has a knock-on effect when it comes to work and productivity.

“That’s why it’s important for employers to take a role in helping their employees to get on top of their finances. It’s not about paying people more, but helping them with education, advice and ways to make their salary work harder by offering pay advances, savings and low-interest borrowing options.”

Almost a third of those surveyed regularly run out of money before payday and are forced to resort to high-interest payday loans, credit cards and overdrafts to get them through to the next pay cheque, all of which contributes to an increase in the stress and anxiety they feel on a daily basis.

The UK’s most financially stressed cities, ranked

-ENDS-