12th December 2022

Regulatory fines for FTSE 100 companies see fourfold increase to £1.6bn in past year

- Increase in value of fines driven by natural resources and energy and financial services sectors

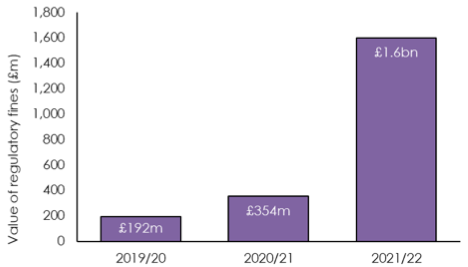

Fines imposed by regulators* on FTSE 100 companies have jumped more than fourfold in value in the last year, from £354m in 2020/21 to £1.6bn in 2021/22**, shows new research by the Thomson Reuters Regulatory Intelligence.

FTSE 100 natural resources and energy companies account for the largest proportion of those of fines in the past year, at almost £1.1bn or 69% of fines per value. The FTSE 100 financial services sector has seen the highest number of regulatory fines in the last year, at 11, totalling £354m or 22% of the regulatory fines by value.

Since the Global Financial Crisis, regulators have taken a much more active role in ensuring corporates fully comply with regulations. Whilst that increase in regulation has been most obvious on the financial services sector the trend towards more active regulatory enforcement has also been highlighted in areas such as data protection and competition. As well as an increase in regulation, regulators have stepped up the level of fines that they impose.

In 2021, Thomson Reuters Regulatory Intelligence recorded 64,152 regulatory alerts (significant regulatory changes) across 190 countries, with 67,125 recorded in 2020. In comparison, the average number of alerts in the previous decade (2010/19) was just 33,954 per annum.

Mike Cowan, Senior Regulatory Intelligence Expert at Thomson Reuters Regulatory Intelligence says: “Regulators are clearly willing to impose very large fines as they clamp down on corporates suspected of breaching regulations. The aim of regulators has been to get fines up to the level where they are a real deterrent. Regulators like the FCA or SEC do not want fines to be seen as an acceptable cost of doing business.”

“In recent years regulators have been given more powers to fine corporates as a percentage of their turnover – for example for breaches of GDPR or of competition law. Potential fines of that scale ensure that legal and regulatory compliance is a boardroom issue.”

“Corporates need to make sure their compliance systems are as up-to-date and effective as possible in order to avoid incurring penalties. This may require additional up-front investment but can save corporates enormous amounts of money over the long-term.”

“The increasingly international nature of FTSE100 companies means that they are having to deal with a patchwork of different regulators across their business. That not only increases the risk that they will fall foul of regulatory or statutory rules but it also increases the risk that they can be fined by multiple regulators in different jurisdictions for the same mistake.”

Corporates facing increasing regulatory pressure on culture and supervision

Thomson Reuters says corporates are facing pressure from regulators not only for actual breaches of regulations, but also the wider culture of the company regarding supervision and the controls it has in place for compliance with regulations. As well as the corporate as a whole, regulators are also increasing scrutiny on chief executives and management teams, to ensure regulatory compliance is adhered to throughout the organisation. Several regulators have introduced senior manager accountability regimes, which can hold senior managers personally liable should things go wrong in their firm.

Corporates are increasingly trying to balance competitive and compliance pressures. Many respondents in Thomson Reuters’ recent Cost of Compliance 2022: Competing Priorities report cited a growing friction between performance pressure and remaining compliant with all relevant regulations.

The report also found that corporate compliance teams are expected to do more with less in 2022. Despite an overwhelming majority of firms expecting regulatory activity – and therefore their workloads – to increase next year, most respondents (61%) think their compliance teams will stay the same size. In addition, only 12% of firms expect budgets to increase significantly in the next year, with 50% saying they expected them to rise slightly. Given the increased scope of regulatory activity, this suggests that firms expect to find themselves under greater pressure to deliver more work without a commensurate increase in resources.

Value of regulatory fines against FTSE 100 companies jumps fourfold to £1.6bn in 2021/22