11th May 2021

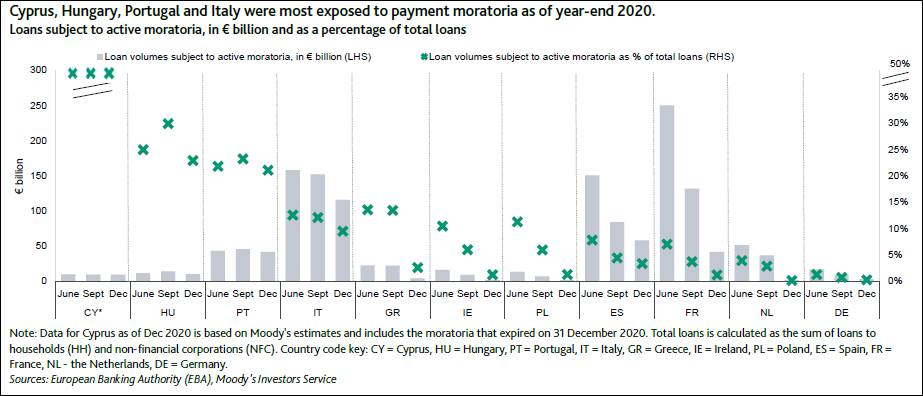

The loans on the books of EU banks that remain under long-running moratoria are more likely to underperform, with credit quality particularly uncertain in Italy, Cyprus, Portugal and Hungary, Moody's Investors Service said in a report published today.

“We expect problem loans to increase in most EU countries as government support measures are reduced,” says Bernhard Held, a Vice President - Senior Credit Officer at Moody's and author of the report. “The remaining loans benefiting from moratoria will be the main pockets of potential credit deterioration, because they are likely to be of weaker credit quality than those that resumed repayments earlier.”

Measured by the coverage of active moratoria loans and other exposures with a deteriorated credit quality through loan loss reserves, the banking systems in Cyprus, Italy and Portugal appear most vulnerable to weaker credit performance during 2021.

The full report and corresponding press release is attached. Please get in touch if you would like to speak to Bernhard Held, the author of the report.