10th December 2019

Dividends hold the key to long-term share price growth

- Dividends hold a stronger relationship to share prices than profits over time

- The relationship holds true in most parts of the world, but is especially strong in Asia over the last decade

- The association between dividends and share prices is 2.5x stronger in Asia than between profits and share prices

- The same pattern holds true across almost all the main Asian markets, and across almost every sector

- Moreover, dividend growth in Asia has far surpassed the rest of the world too, and HFEL’s forecast is for this to continue into 2020

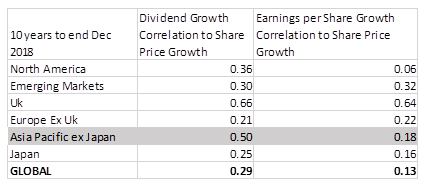

Dividends have proved a more reliable indicator of share price growth over the last ten years than profits, according to new research from Henderson Far East Income (HFEL), an investment trust focusing on income-generating companies based in Asia-Pacific excl. Japan. Moreover, the connection between dividends and share prices has proved much stronger in Asia than it has in other parts of the world. Only the UK shows a stronger relationship though the actual growth rates for UK dividends and profits have been much slower than in Asia. So, while the focus of most stock-market commentary is on earnings and profits, HFEL’s findings suggest that investors are well advised to pay close attention to dividend growth too.

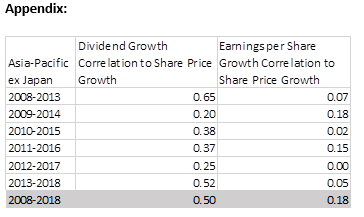

Over the last 10 years[1], the link between share price growth and dividend growth in Asia-Pacific has been more than 2.5x stronger than that between profits and share prices (correlation of 0.5 v 0.18). In other words, half of the change in share prices is associated with dividend growth, but less than a fifth is associated with profit growth. Moreover, these relationships hold true over every five-year period within the last decade too (see appendix).

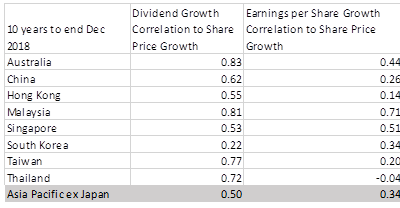

The same pattern can be seen in every major country in Asia-Pacific too over the last ten years, with the exception of South Korea. Here the ten-year association is rather weak, though it holds true here over every five-year period. South Korean companies are half as likely to pay dividends than companies in the rest of the region, and this helps explain why the dividend to share price relationship is less strong. Share prices in Malaysia, Australia, Taiwan and Thailand have all been especially strongly associated with dividend growth over the last decade.

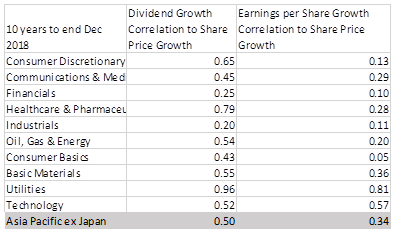

Sector comparisons also bear out the relationship, with the exception of technology, where profit growth and dividend growth share a similar association with share price rises over time. Utilities exhibit the strongest link between dividends, share prices and earnings. This is because utilities pay out an exceptionally high proportion of profit in dividends (a two-thirds payout ratio on average globally[2]), and because their earnings are relatively predictable.

Asia-Pacific has seen much faster dividend growth than the rest of the world. Since 2009, payouts in Asia-Pacific (excl. Japan) have more than tripled, rising 216% by the end of September[3], an average annual increase of 12.9%. Dividends outside the region have also done well, more than doubling over the period in sterling terms (up 121%, or 8.7% per year on average)[4], but clearly have not been able to match the Asian advance.

In the year to the end of April 2020, Henderson Far East Income expects corporate profits across the region to see low single digit growth but anticipates dividend growth to be faster than this, because there is room for payout ratios to expand.

Mike Kerley, manager of Henderson Far East Income said: “A key element of the investment case for Asia is a structural shift that has seen companies increasingly adopt a dividend-paying culture. Our research shows that this is unlocking long-term value for shareholders.

“Too often people consider themselves either income investors or growth investors. But in truth, investing in a broad spread of companies with growing dividends is an investment strategy that has historically delivered extremely attractive capital gains too. This is explained by simple maths: if we assume, for the sake of argument, that a stock’s yield[5] remains steady over time, then a dividend growing 10% pa means the share price must rise by 10% pa too. Obviously in the short term, events intrude and market conditions change, but our research shows that over the long term the relationship undoubtedly holds true.

“A growing income helps protect income investors from the effects of inflation, but it also helps protect their capital too. And for growth-oriented investors who do not immediately need an income, reinvesting dividends is one of the most effective ways of accelerating capital growth through the power of compounding.

“A company can only sustain its dividends if it is both profitable and generating cash, and it can only sustain dividend growth if profits and cash flow grow over the longer term. This helps explain why a focus on profits alone is less reliable when thinking about long-term returns – on their own profits don’t necessarily mean a company can generate the cash that is vital to investor returns, particularly since companies can use accounting tricks to flatter their reported profits. Cash is much less forgiving! A

clear dividend policy represents a commitment to paying cash to investors in a way that guiding investors on the outlook for profits does not. Investors should rightly view mature companies that consistently do not pay dividends with some scepticism.”

-ENDS-