08th September 2020

UK savers holding £1.5 trillion in cash costing them £38bn in lost income, Janus Henderson Investment Trusts

Record cash piles cost UK savers £38bn in lost income as interest rates languish near record lows

· Lockdown and recession fears push household cash balances up £77bn in first half of 2020

· Savers now have £1.5 trillion in cash stashed away, the biggest cash pile on record

· This vast cash pile is equal in size to the UK’s collective mortgage debt

· Almost £1.2 trillion of this cash is not needed to meet household contingencies and is sitting unproductively earning minimal interest

· Savings interest rates are near record lows, while yields on equities are near record highs which means that in the last twelve months savers missed out on some £38bn of income – equivalent to £1,350 for every household

· Investors seeking protection from a further slump in equity dividends are able to secure an income of around 15 times as much as a cash savings account through Investment Trusts

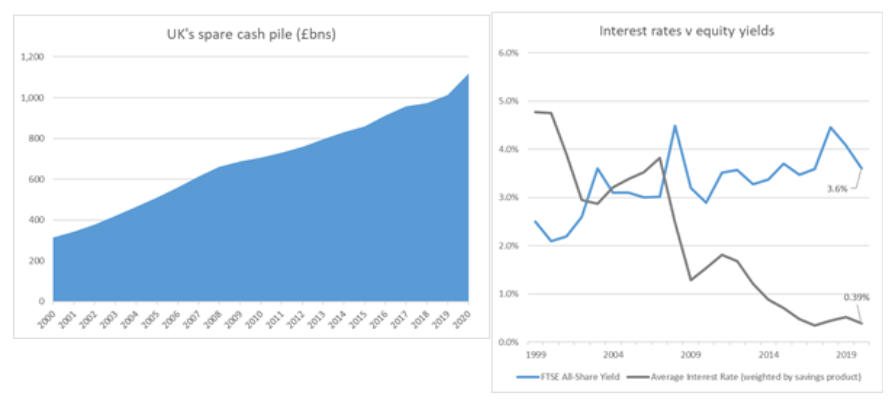

The lockdown and fears over the severity of the Covid-19 recession have prompted households to save cash at a record pace, according to Janus Henderson Investment Trusts. In the first six months of 2020, they stashed away £77bn, far more than the previous record set for a full year (£82bn in 2016). An eye-watering £1.5 trillion[1] of cash is now tucked away in savings accounts. The savings glut, which is spread across ISAs, savings accounts and current accounts continues to increase. This vast sum is roughly equal to the combined value of all UK residential mortgages[2].

UK households are however only earning tiny amounts of interest on these savings – just £5.7bn over the whole of 2020. This is more than the record low of £4.6bn in 2017, reflecting a huge increase in savings balances (up by £210bn) and a tiny increase in average savings interest rates (up from 0.35% in 2017 to 0.39% presently[3]). On current trends, savings interest rates are likely to fall below 2017’s record low.

2007 was the record high point. In that year, savers earned £33.1bn, despite having cash balances two fifths smaller than today. It took 5 full years (from 2015-2019) for the UK’s cash savings to earn the same amount of interest income, now that interest rates are so low, even with much higher cash balances earning interest.

As a rule of thumb, personal finance experts recommend that families set aside in cash at least three months of income, to help them weather any sudden change in circumstances. That implies that about £370bn[4] is required for UK households’ collective ‘contingency fund’.

Nevertheless, the data shows they have tucked away over 4 times this amount – which means banks have the use of almost £1.2 trillion in spare cash that their customers could be investing elsewhere.

Although interest rates had been slowly inching upwards since the financial crisis, averaging 0.52% last year, they have fallen sharply in 2020. By the end of June they were just 0.39%. UK households’ hard-earned cash is therefore still going markedly unrewarded. This year, even with the record cuts announced to dividends by UK companies, Link Group’s recent Dividend Monitor forecast that they will pay between £56.3bn and £60.5bn. Therefore, £1.17trillion of UK equities will provide £42.3bn of income, six times more income than that capital would earn if it were idling in cash. If you deduct the interest income forgone by investing in equities (£4.6bn), then that capital would earn an additional £37.7bn, equivalent to £1,350 per household, if it were evenly spread.

For those looking to save for at least five years, looking beyond just cash holdings can reap significant benefits. The City of London Investment Trust, which invests primarily in UK equities, recently reached a dividend yield of 6.03%[5]. £1,000 invested in this investment trust would provide income of £60 over the next year, around 15 times as much as a cash savings account. City of London Investment Trust holds the record of uninterrupted annual dividend increases since 1966.

James de Sausmarez, Director and Head of Investment Trusts at Janus Henderson said: “UK savers are squandering the opportunity to earn tens of billions of pounds extra in income on their savings. In my view, interest rates are set to stay low for a very long time, so there is no light at the end of the tunnel for cash.

“For every one of the last thirteen years, shares have provided a better income than cash. But even years of ultra-low interest rates have not deterred savers from stowing away a record amount of it. Indeed, the amount of spare cash idling unproductively in bank accounts is now, on average, equivalent to almost a whole year of household income, or the entire UK mortgage debt.

“What’s more, this cash is not evenly spread around, but instead is concentrated in the hands of wealthier households. That suggests there is even more than £1 trillion in cash that isn’t needed to meet contingencies and is therefore available to invest much more productively. Banks call this ‘muppet money’ because they know savers are missing out on much better opportunities elsewhere.

“Some can be deterred by the turbulence of global stock markets – especially as we saw in the first part of the year. Dividend payments have also been badly affected this year, but UK companies will still pay tens of billions to their shareholders, far more than could be earned on cash. And dividend payouts will make up some of the lost ground next year; investment trusts like City of London have the advantage of being able to smooth the income they pay to shareholders too. The Trust has been able to maintain its payout through the crisis. Over the long term, investing in shares has not only provided a healthy income, but also the scope for capital gains too, protecting savings from the ravages of inflation.

“To keep things simple, we have only illustrated the point here by comparing UK savings interest rates with UK equity yields. But there is an investment trust to suit every appetite: some more focused on income, some more focused on growth, some with more international portfolios. Even those parts of the world with the lowest equity yields are providing a superior income compared to UK savings rates.”

-ENDS-