8th April 2020

Mortgage Lenders Adjust to Remote World by Easing Rules on Valuations

Private banks once opposed to accepting remote and desktop valuations began tentatively changing their approach this week in a move that could stem sharp declines in prime property market activity.

For many private lenders, in-person valuations in which a surveyor visits a customer’s home were considered essential before granting loans to buy or remortgage properties. Desktop and remote valuations were largely the domain of the high street lenders. That was before the onset of the Covid-19 crisis, when banks were beset by challenges that included two Bank of England emergency rate cuts, the introduction of three month mortgage holidays and the lockdown of many international based processing centres.

Then, when restrictions on movement rendered in-person valuations almost impossible, some private banks pulled back from granting loans to purchase homes altogether. That is already beginning to change as the larger private banks begin coming to terms with the prevailing conditions by accepting remote and desktop valuations.

“Two weeks ago there was a lot of confusion and adjustment happening, with people firefighting trying to work out what they were supposed to be doing,” says Alex Ogario, Head of the Private Office at Knight Frank Finance. “Now banks that weren’t going to accept desktop valuations are coming to the realisation they will need to. The big lenders with the big balance sheets tend to be on board, and that’s good for the market because transactions can continue to a certain extent.”

The property market surged in the wake of December’s decisive general election victory. Lending for house purchase reached a six-year high in February, according to Bank of England data. Prices in prime central London climbed 0.2% in the first quarter of 2020, the largest first quarter increase in five years, according to Knight Frank data published yesterday.

Now, as a result of the pandemic, Knight Frank Research forecasts London house prices will decline 2% in 2020 before rebounding to 6% growth in 2021. The evolving approach from the private lenders is likely to ease declines in activity in higher value markets like London.

Lenders have been approaching valuers to better understand what is required to provide robust desktop valuations in order to make decisions on their processes and policies, says Katie Parsonson, head of Knight Frank’s London Valuation and Advisory team.

“We’ve been positively reassured by the number of fee quote requests, from lenders for desktop valuations across the core and super prime market in London” says Parsonson. “These have ranged from £1 million homes through to single home developments of £20 million to £30 million.”

COVID-19 - The impact on the UK Hotel Market and its forecast recovery

by Philippa Goldstein, Hotel Analyst, at Knight Frank

What cost will this public global health crisis have in economic terms and how long will it take for the UK hotel market to recover to pre-COVID-19 levels?

The contagious nature and transmission rate of COVID-19, resulting in the far reaching geographical spread of the coronavirus, demonstrates just how connected and globalised the world has become.What cost will this public global health crisis have in economic terms and how long will it take for the UK hotel market to recover to pre-COVID-19 levels?

The economic consequences from COVID-19 will be stark and hotels are likely to be disproportionately impacted. With the ongoing enforced lock down, the current focus is one of survival, with cash conservation and liquidity of immediate concern. The range of fiscal measures put in place by the UK government, in particular the business rates 12-month holiday for the hospitality sector, together with the ability to furlough staff for an initial period of up to 3-months, have substantially reduced the holding costs to hoteliers of a closed hotel operation.

To be ready and responsive to the opportunities ahead and to provide hope at this time of great uncertainty, we take a look at how the UK hotel sector has survived past events. Whilst the immediate economic impact is anticipated by many to be more severe than past economic downturns, we outline what the forthcoming recovery may potentially look like.

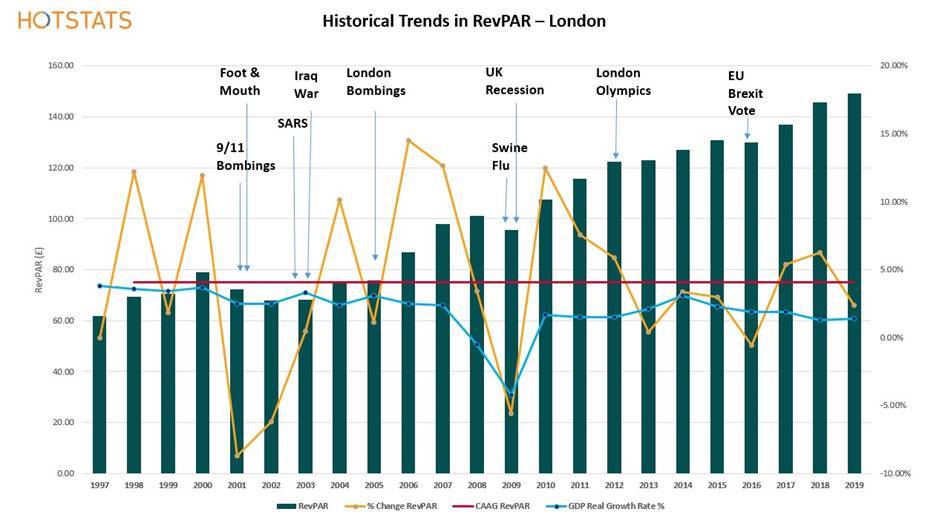

With the use of HotStats data, the graph below shows London’s RevPAR performance over a 20-year period and what becomes immediately apparent is the resilience over time of the London hotel market.

The change in global travel and the changing patterns in leisure spend have contributed to the strength and robustness of the sector;

- London has achieved a compound annual average growth in RevPAR of 4.1% since 1997.

- Since the global financial crisis of 2008, London achieved year-on-year RevPAR growth of 4.6%, despite strong growth in hotel supply of 35%, to over 160,000 rooms.

- Appreciating the challenges coming from a period of lockdown and the enforced total sector paralysis, we anticipate the sector will rebound strongly once the economy revives and travel restrictions are lifted.

- We envisage a V-shaped, stepped recovery. Occupancy growth will be stronger during the initial phase of recovery, but the rebound in RevPAR will only fully recover once travel restrictions are eased and long-haul inbound visitors return, which will help drive the ADR growth.

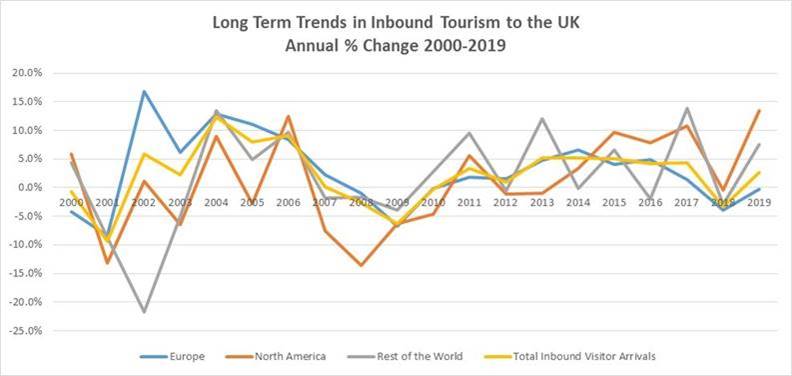

Prior to the outbreak of COVID-19, the global economic crisis in 2008 was the last occasion when the UK witnessed a decline in inbound visitor arrivals. The graph below shows the year-on-year changes in inbound tourism to the UK, with declines in Total Inbound Visitor Arrivals in both 2001 and 2009.

Source: Visit Britain

The key takeaway from the above two graphs is the speed with which the markets recover after major events such as the economic downturns in 2001 and 2009. This provides us with confidence when forecasting the likely pattern of recovery this time around, in whilst there are many unknowns, there is hope for a reasonably swift return to positive growth figures.

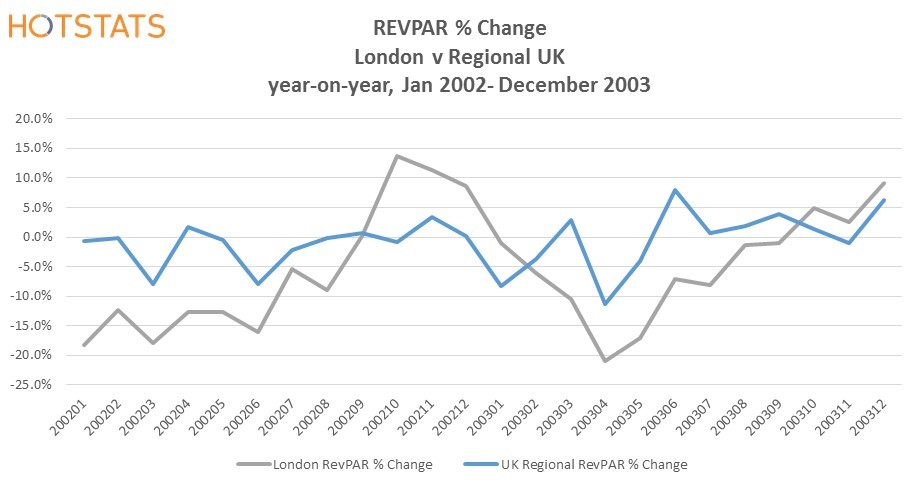

Looking at the period post SARS in 2003, of particular interest is the difference in recovery between London and regional UK. Despite the outbreak of SARS predominantly being confined to China and South East Asia, long-haul travel to the UK was affected.

London witnessed a more severe decline in RevPAR, 21% at the peak of the decline in April 2003.

· Monthly RevPAR data highlights regional UK recovering sharply over a two-month period in May and June 2003.

· London’s RevPAR witnessed an early boost, but took a full six months to recover, before long-haul inbound visitor arrivals was fully restored.

· Following the US terrorist attrocities in 2001, London’s RevPAR took almost 12-months to recover.

· Due to the global crisis of COVID-19, containment of the virus will vary significantly by country, as such restrictions on overseas travel will undoubtedly take place over an extended period of time.

· The UK hotel markets which have a strong international appeal, such as London and Edinburgh, are likely to endure a longer period of recovery.

What will be the ultimate impact of COVID-19 on economic growth – a severe but short-lived downturn, or one that is more protracted?

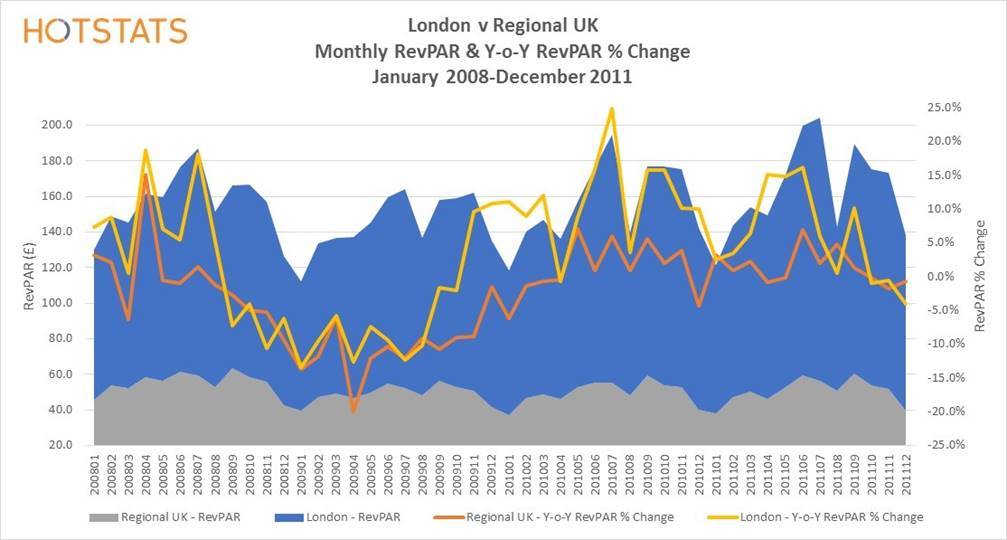

The following graph looks at the recovery period on a monthly basis following the global financial crisis of 2008, with Regional UK shown to have a more severe and drawn out recovery than compared to London.

London took a full 14 months to return to a level of RevPAR similar to pre-crisis, but following London’s lowest point of the crisis in August 2009, the revival of London’s hotel market was impressive. By December 2009 London had achieved RevPAR growth of 3.9% greater than the same period prior to the crisis.

· The potential for the London market to rebound strongly once COVID-19 is contained and travel restrictions eased is positive, albeit the recovery up the curve will take time. Assuming, the hotel market reopens by the end of Q2, we would anticipate a full market recovery by Q2-2021, with further market specific growth thereafter.

· The severity of the economic downturn will likely have a more lasting impact on the performance of the regional UK hotel market. Corporate budgets are likely to be squeezed, whilst the level of unemployment will dictate the disposable income available and therefore the propensity to spend on leisure-based experiences.

· Changes to a hotel’s segmentation mix will ultimately impact upon a hotel’s RevPAR, but a decline in occupancy, is not a prerequisite for lowering the room rate in an effort to stimulate demand. As a result of the UK recession in 2009, the regional UK market suffered 21 months of year-on-year declines in RevPAR and took five years to recover the loss in RevPAR, which was largely attributed to the fall in the average room rate. Many lessons can therefore be learnt from the financial crisis of 2009, to prevent a protracted and painful recovery in the regional markets.

Recovery Plan for 2020

· Recovery, in particular for the regional UK market will be focused on driving domestic demand. On a normal year, domestic overnight visits account for approximately 76% of total visits in the UK, yet represent only approximately 58% of total annual room nights. With the widespread outbreak of COVID-19 across Continental Europe and the USA, capitalising on a share of the 47 million annual outbound visits made in 2018 by UK residents holidaying abroad, the potential for increased room nights in the leisure segment could be significant.

· With all schools closed and deemed unlikely to return until September, the traditional 6-week summer holiday period will effectively be extended, allowing families the opportunity to take a UK holiday perhaps in June or early July, assuming the restrictions on social distancing have been sufficiently eased to allow this. Rural and coastal areas are likely to benefit and see a greater uplift in trading. Regional UK, therefore has the potential to benefit from sources of demand not previously at its disposal pre-COVID-19.

· Where there is a growing and urgent need for the provision of short-term accommodation for key medical workers, sizeable, city-centre hotels in close proximity to hospitals are likely to benefit. Demand generated from the NHS sector is expected to continue until late September and will form an important part of the early recovery for city-centre hotels, both in London and regional UK.

· As restrictions on social distancing are eased, many hotels may decide to remain closed until they are confident that occupancy levels on re-opening are sufficient to ensure that any operating losses are less than the holding costs of keeping the hotels closed. Thus we may see many hotels delaying re-opening rather than opening as soon as the restrictions permit. As a result this could have a positive impact on the trading performance for those hotels which do open from the outset. We might also see some of the larger chains, who have multiple hotels in the same geographic markets, phasing the opening of their hotels. Hotels which depend to a large extent on the meeting & conference segment, might well stay closed for a prolonged period.

Once travel restrictions are eased, investment activity will resume, but with a time lag for the due diligence involved, we envisage Q4 will witness a surge in activity.