8th April 2019

Pets at Home^

The pet care business

Pets at Home (‘Pets’) last reported through its Q3 trading statement on 22nd January 2019, which confirmed that the company delivered strong trading during Q3 (12 weeks to 3rd January 2019) that saw retail revenues grow 5.5% overall, with LFL growth of 4.7%. The vet division grew sales by 13.6% during Q3, the re-set is starting to come together, and the company highlighted that good progress is being made in the discussions with joint venture partners in buying-back practices. The company has now entered its closed period, ahead of prelim results on 22nd May. We, therefore, assume that the company continues to be comfortable with FY2019F consensus PBT of £83m and EPS of 13.2p, given that there has been no update since the January trading statement. We continue to believe that Pets operates in an attractive market with structural growth. The business is on the right track again to us, but there remains much work to do before earnings start to rebuild towards historic levels. We expect the shares to tread water for the time being and, therefore, reiterate our HOLD rating.

Investment in prices is delivering sales growth in the retail division

Pets has worked hard to reposition its proposition on price and this is reflected in the positive LFLs that the retail division has posted in recent quarters. The investment in product pricing came at a cost to gross margins, which at the time of the interims back in November saw a decline of 129bps in the period.

Vets business being reset

The company deserves credit, in our view, for addressing the issue of underperforming vet practices. 55 of the 471 practices have been highlighted as underperforming, so the company will offer to buy them back from their joint venture partners. 25 of these will be operated as company managed practices, whilst options for the remaining 30 practices will be considered, including closure. The company will incur exceptional costs of c.£49m over the next two years, of which £27m will be cash costs, as a result of this action.

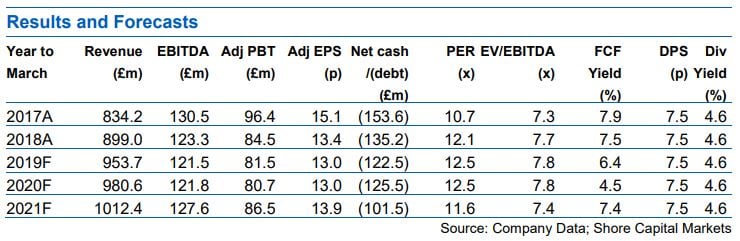

Valuation looks up with events

In terms of valuation, Pets trades on a one year forward (year to March 2020F) PE multiple of 12.5x and an EV/EBITDA multiple of 7.8x. Given the re-set in the business, FY2019F and FY2020F are transitional years, as the company regroups to deliver sustainable growth over the medium term. We believe that the shares look up with events for now and, therefore, reiterate our HOLD rating, noting an attractive 4.6% dividend yield.