What rate of wage growth is acceptable for central banks?

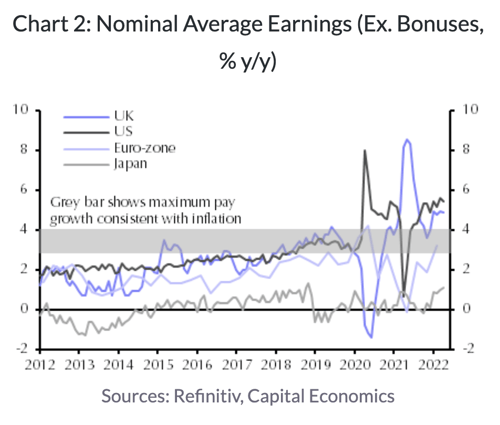

- Even though workers are accepting cuts in their real pay, nominal wage growth is still above “acceptable” rates for central banks in DMs of 3% to 4%. This underlines why interest rates need to head into restrictive territory to weaken economic activity sufficiently to bring wage growth back down to these rates.

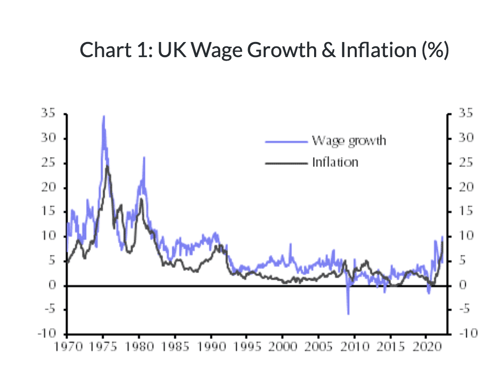

- The priority for central banks is to prevent a repeat of the wage-price spiral of the 1970s which was seen most starkly in the UK. (See Chart 1.) It is obvious that the “inflation-busting” demands in some quarters of double digit pay rises are “too much”. That begs the question of what is an acceptable rate of wage growth.

- We typically think of the rate of wage growth compatible with the inflation target as equalling productivity growth plus the inflation target. Underlying productivity growth in DMs is 1% to 2%, meaning that wages can rise by 1% or 2% without pushing up the costs per unit of output for firms. Adding on the 2% inflation target results in a sustainable rate of nominal wage growth in most DMs of 3% or 4%.

- This suggests that any rate of pay growth above this is unwelcome for central banks, as it will push up firms’ unit labour costs, prompting them to raise their prices. As a result, even once the temporary upward influences on inflation (e.g. higher energy costs) ease, inflation, despite falling, would remain above its target. In turn, this would fuel further wage demands of above 3%-4%, keeping the vicious cycle going.

- There are some potential “get-outs”, but none seem to apply now. The first is if productivity growth accelerates, justifying the rise in wage growth. But even in the best performing economies, productivity growth over the past couple of years has been broadly in line with pre-pandemic average. (See here.)

- The second is if firms absorb the rise in wage costs in their profit margins, breaking the wage/price cycle. That might occur if demand were soft enough to weaken firms’ pricing power. However, we know that measures of core inflation have been accelerating, suggesting that firms’ pricing power is relatively strong.

- The third is if wage pressures alleviate of their own accord, either because the drop in real wages weakens aggregate demand and the demand for labour, or because the labour supply rises. But we explained before why the cost of living squeeze is unlikely to do all of central banks’ job for them. (See here.) And any rise in the labour supply is unlikely to materialise quickly enough. (See here.)

- The bottom line, then, is that the current rates of 5% to 6% in the US and UK are “too much”, even though workers are nonetheless accepting big real pay cuts. (See Chart 2 - note that although nominal pay growth has been distorted by sectoral shifts during the pandemic, estimates of underlying pay growth are also above the 3% to 4% range. See here.) Wage growth in the euro-zone is not at worrying rates yet, but will be soon if the recent acceleration continues as we expect. (See here.)

- All of this highlights why central banks will need to raise interest rates until they can be confident that higher rates are restraining economic activity sufficiently to reduce employees’ bargaining power (to prevent wage growth from following inflation up) and reduce firms’ pricing power (so they absorb any rise in wage growth into their profit margins and prevent inflation from following wage growth up).