05th March 2019

Pensions Regulator fires warning at companies neglecting pensions while paying fat dividends

AJ Bell press comment

The Pensions Regulator (TPR) has this morning published its Annual Funding Statement for defined benefit (DB) schemes. You can find the whole document here: https://www.thepensionsregulator.gov.uk/en/media-hub/press-releases/tpr-is-clear-about-its-expectations-for-db-schemes-planning-their-long-term-strategy

Key points:

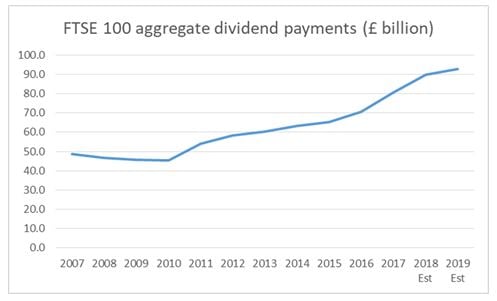

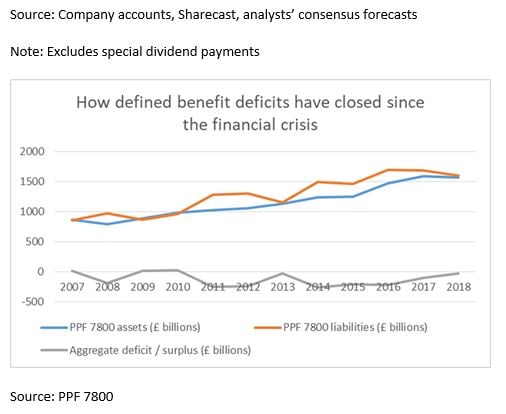

- Concerns raised about “disparity” between dividend growth and companies paying down defined benefit (DB) deficits

- Regulator reveals proactive attempts to contact schemes where it was concerned about possible inequitable treatment in 2018

- Latest Pension Protection Fund data suggests UK schemes have total combined deficits of £23.1 billion (Source: https://www.ppf.co.uk/ppf-7800-index)

- FTSE100 firms paid out an estimated £89.9 billion in dividends to shareholders in 2018

Tom Selby, senior analyst at AJ Bell, comments:

“The Pensions Regulator has clearly got its sights set on companies who flagrantly ignore their responsibilities to pension scheme members in favour of rewarding shareholders.

“The regulator’s approach is one of hard-nosed pragmatism. While understandably it wants deficits to be plugged as soon as is possible, coming down like a tonne of bricks on strong companies by restricting their ability to reward shareholders would risk strangling economic growth.

“It could also prove counterproductive if this led to a collapse in vital investment and thus weakened the company ultimately responsible for paying pensions. In this sense the regulator is performing something of a pensions high-wire act.

“For investors, the regulator’s tough stance re-emphasises the importance of assessing all factors that could potentially affect a company’s long-term growth, including any pension liabilities.”