05th May 2020

COVID-19 impact will see UK investors move to safer retail deposits, says GlobalData

Retail investors in the UK will gravitate towards deposits and away from riskier high-yielding assets, according to leading analytics company, GlobalData.

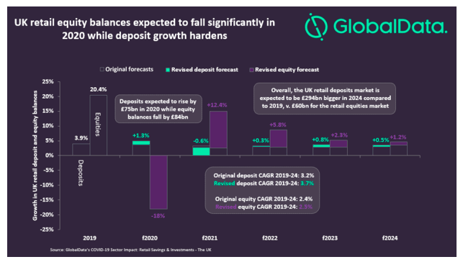

GlobalData’s report, ‘COVID-19 Sector Impact: Retail Savings & Investments – The UK’, reveals that equity balances are expected to fall by 18% in 2020 alone while retail deposit balances grow by 5%. While the decline for equities is made up for in the following years, the higher growth and large initial size of the retail deposits market shows the extent to which investors are set to turn towards safer assets.

Katherine Long, Banking and Payments Analyst at GlobalData, comments: “Higher deposit growth is also likely to benefit both incumbent and challenger banks. Already, retail savings platforms Raisin and Hargreaves Lansdown reported a surge in activity in March with savers looking for short-term, fixed-rate deposits.

“Their offers of deposit protection potentially above the usual £85,000 limit as well as interest rates of up to 2% make them a tempting case for consumers who are still nervous to invest. Additionally, with base rates lowered to just 0.1%, banks will be able to take advantage of consumer nervousness by simply offering a safe place for customers to store their money.”

In contrast, global stock markets have fallen drastically, The FTSE All-Share Index for example now down 24% after having recovered somewhat from the initial slide, but still volatile. The value of UK pensions, too, according to XPS Pensions, is down 8.4% in one quarter and expected to fall further, a reminder of how exposed pension funds are to the stock market.

Long concludes: “However, rather than prove a short-term phenomenon, the disruption has reversed the recent trend of retail investors looking for higher-yielding assets, instead seeking to bolster their safety net in deposits.”

ENDS