04th March 2019

The gap between buying and renting closing but homeowners still better off

The gap between annual costs of buying compared to renting are lowest in almost a decade

- Latest figures show savings buyers are saving £366 per year, compared to £900 in 2017

- Homeowners are still better off than renters in all parts of the UK when all costs are considered

The gap between the cost of buying and renting is down 59%, its lowest in nine years, according to the latest Halifax Buying vs. Renting Review.

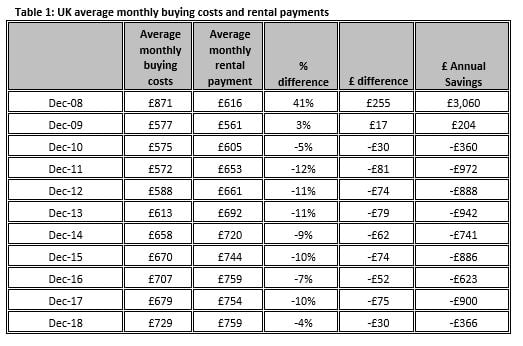

In 2017 buyers were saving an average £900 a year compared to renters but the latest figures show this saving is down to £366. Housing costs,[1] including a mortgage on a three-bed home in the UK, were £729 a month in December 2018, compared to the average monthly rent of £759 for the same property type. (Table 1)

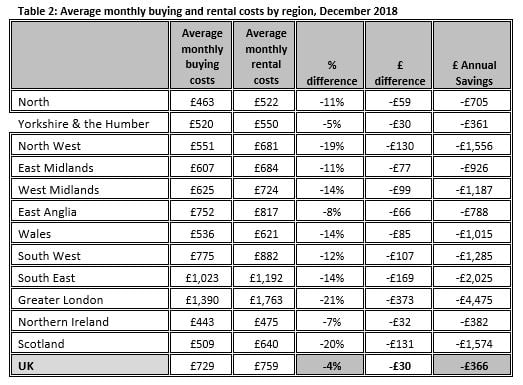

Buying in recent years has meant lower monthly costs than renting across the UK but the latest picture shows an uneven snakes and ladders effect. Outside of London, Scottish buyers have the highest average annual savings of 20% (£1574) vs renting, compared to the most humble financial gain in Yorkshire, where the cost of buying is only 5% lower than renting (£361 Table 2).

Regionally, buyers are better off than renters in Wales with annual savings of over £2000 (14%) where by in Northern Ireland mortgage payers are saving 7% less than their Welsh counterparts at £382 annually.

New Buy to Let mortgages have slowed down and first-time buyers are now driving the number of house purchases with a mortgage. The number of first-time buyers in 2018 hit 370,000 while the number of mortgages for Buy To Let house purchase at the same time fell for the fourth year to 66,400, according to UK Finance figures. Remortgages however have been rising showing the effects of recent changes impacting landlords including an additional charge on stamp duty for new Buy to Lets and the removal of mortgage interest tax relief.

Russell Galley, Managing Director, Halifax, said: “The gap between buying and renting is narrowing, primarily driven by reduced first time buyer prices deposits in some regions and continuing house price growth, meaning buyers are paying more on their mortgages.

“With more products available for borrowers, these factors combined have pushed up the price of buying quicker than the price of renting. Meanwhile, the cost of rent, household maintenance and average deposits have remained broadly flat.”