02th May 2019

Counting the cost of the US-China trade war

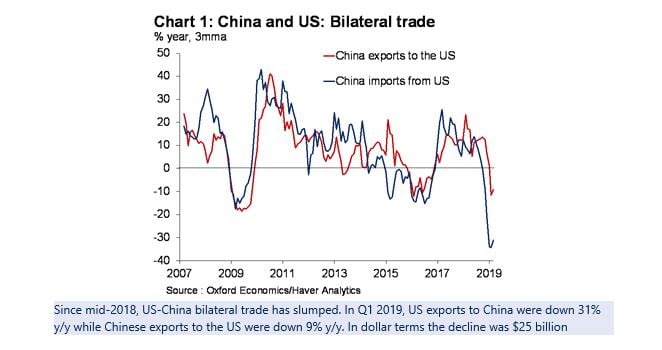

US-China trade has fallen steeply since mid-2018, with a $25 billion decline equivalent to around 0.5% of world trade. US exports to China have suffered the most, but the trade war has also hit Chinese industries hard, with exports to the US of targeted goods down 20%-40% so far.

For the US, the eventual economic costs of the trade war are likely to be small at just 0.1%-0.2% of GDP. These costs are unlikely to be large enough to deter the US from pursuing its geo-strategic goals against China – and potentially other trade partners – via protectionist policies.

China’s Asian trading partners are among the biggest losers from the trade war. But their lower exports to China are being offset to some extent by higher exports to the US – a process of trade diversion which the US is also likely to welcome.

In recent months financial markets have taken a relatively upbeat view of US-China trade policy developments. But that view could be too optimistic. Even if the US and China can secure a deal, we think some of the negative effects of the trade war will linger on.

Last November we looked at the early evidence on who was ‘winning’ the US-China trade war, noting that the verdict of financial markets appeared to be favouring the US.

Focusing on developments in bilateral trade flows and the latest evidence on the likely economic costs, we update our analysis. We conclude that financial markets may be taking an overly optimistic view of the outcome. We think the negative effects of the US-China trade dispute are likely to linger and further trade disputes remain a very real risk.